2020 tax estimator

Golden State Stimulus II Estimator. There are seven 7 tax rates in 2020.

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

2020 MBT Forms 2021 Michigan Business Tax Forms Corporate Income Tax.

. Currently there is no computation validation or verification of the information you enter and. You can now access estimates on property taxes by local unit and school district using 2020 millage rates. The individual income tax estimator helps taxpayers estimate their North Carolina individual income tax liability.

Use the 2020 Tax Calculator to estimate your 2020 Return. However do not include in box 14 any amount of deferred employee Tier 1 RRTA tax that was not withheld in 2020. If you received a Letter of Inquiry Regarding Annual Return for the return period of 2021 visit MTO to file or 2021 Sales Use and Withholding Taxes Annual Return to access the fillable form.

Use your estimate to change your tax withholding amount on Form W-4. The Michigan Treasury Property Tax Estimator page will experience possible downtime on Thursday from 3PM to 4PM due to scheduled maintenance. Simply enter the SEV for future owners or the Taxable Value for current owners and select your county from the drop down list provided.

Using the property tax estimator tool is easy as 1-2-3. The majority of 2020 Tax Forms are listed below or you can search for tax forms. Offer valid for returns filed 512020 - 5312020.

The credit is for the 2020 tax year even though the last payments came in 2021 for many recipients. You will then be prompted to select your city village or township along. Golden State Stimulus I.

Select your tax district from the. After You Use the Estimator. The Ohio tax brackets on this page have been updated for tax year 2020 and are the latest brackets available.

Property Tax Estimator Notice. Help With Golden State Stimulus. Or keep the same amount.

To check out the new IRS withholding estimator click here. New Jersey has seven marginal tax brackets ranging from 14 the lowest New Jersey tax bracket to 1075 the highest New Jersey tax bracket. To change your tax withholding amount.

If the return is not complete by 531 a 99 fee for federal and 45 per state return will be applied. 2021 Individual Income Tax Estimator. The undersigned certify that as of July 1 2021 the internet website of the Franchise Tax Board is designed developed and maintained to be in compliance with California Government Code.

Ask your employer if they use an automated system to submit Form W-4. If you attempt to use the link below and are unsuccessful please try again at a later time. Its never been easier to calculate how much you may get back or owe with our tax estimator tool.

The credit is for the 2020 tax year even though the last payments came in 2021 for many recipients. You can use the income tax estimator to the left to calculate your approximate Ohio and Federal income tax based on the most recent tax brackets. 2020 Individual Income Tax Estimator.

For tax year 2020 the foreign earned income exclusion is 107600. Many tax forms can now be completed on-line for printing and mailing. States often adjust their tax brackets on a yearly basis so make sure to check back.

2019 Individual Income Tax Estimator. Many Americans may be eligible for the Recovery Rebate Credit commonly referred to as the COVID stimulus payment. Type in your homes market value.

Our property tax estimator is a great way to estimate your property taxes for the upcoming year. Fillable Forms Disclaimer. Taxes File taxes online Simple steps easy tools.

Use these free online fillable forms to complete your 2020 Return before you sign print and mail your return to the 2020 IRS address. H and R block Skip to content. Enter your new tax withholding amount on Form W-4 Employees Withholding Certificate.

Each marginal rate only applies to earnings within the applicable marginal tax bracket which are the same in New. Since that date 2020 Returns can only be mailed in on paper forms. Tax Brackets and Tax Rates.

Both New Jerseys tax brackets and the associated tax rates were last changed two years prior to 2020 in 2018. Those who may have just purchased a home or recently applied for homestead exemptions may find this tool especially useful. Submit or give Form W-4 to.

What is your filing status on your 2020 tax return. Employee RRTA tax deferred in 2020 under Notice 2020-65 as modified by Notice 2021-11 that is withheld in 2021 and not reported on the 2020 Form W-2 should be reported in box 14 on Form W-2c for 2020.

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Income Tax Slabs Tax Liability Comparison Between 2020 And 2019 Calculator Getmoneyrich

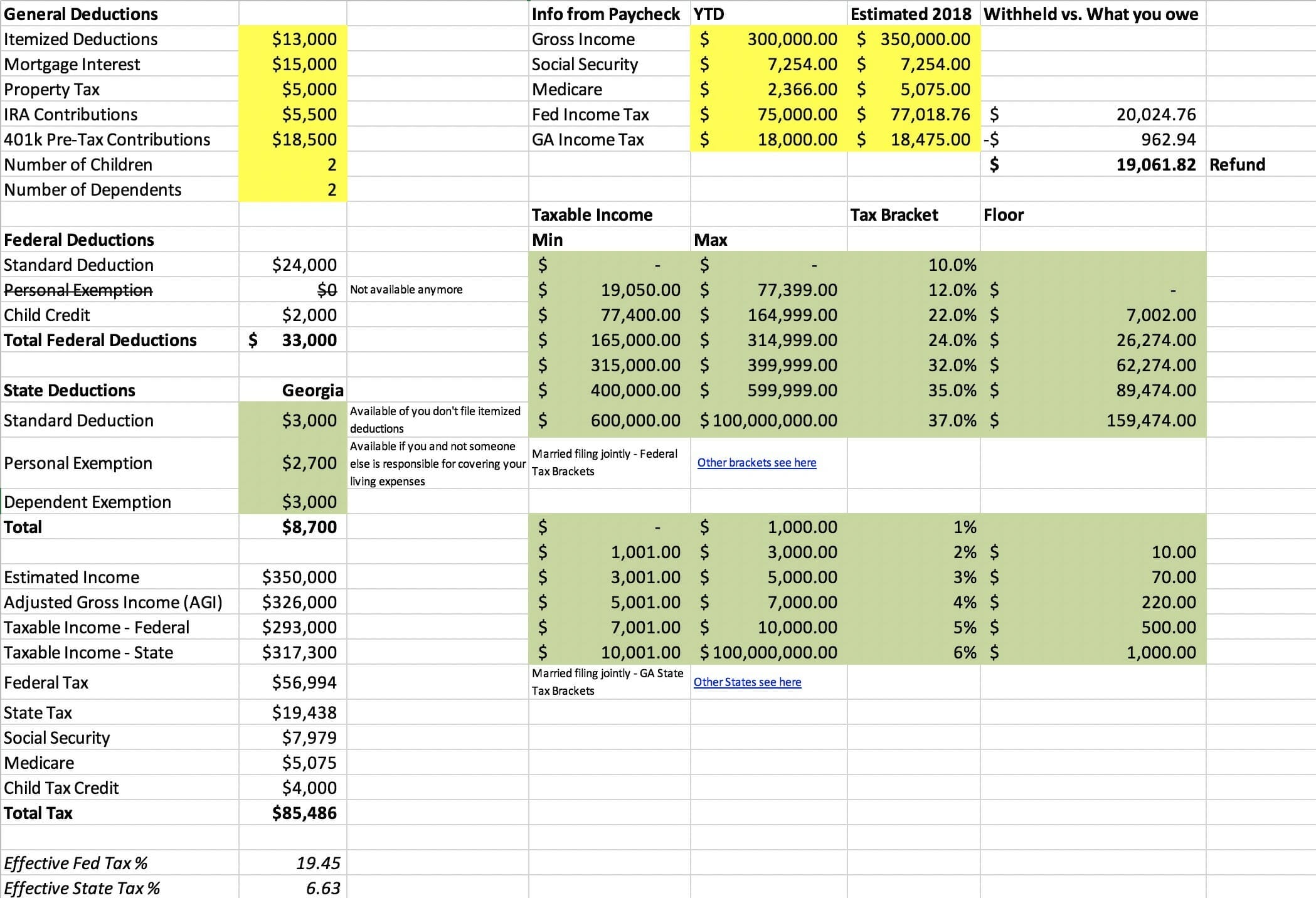

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Income Tax Slabs Tax Liability Comparison Between 2020 And 2019 Calculator Getmoneyrich

How To Calculate Income Tax In Excel

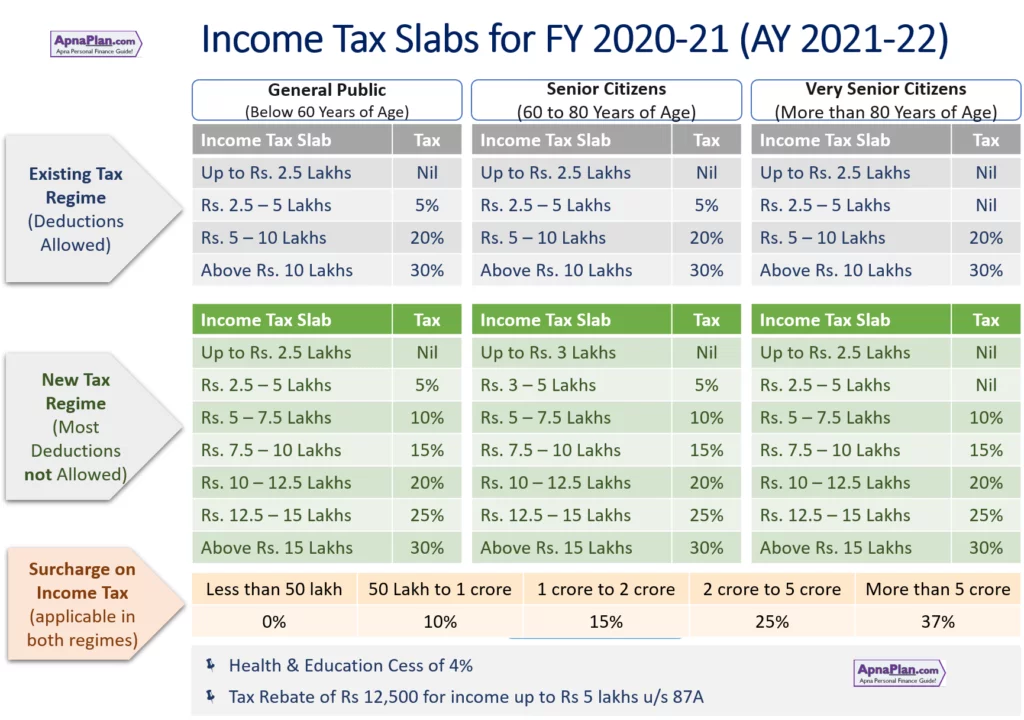

Income Tax Calculator India In Excel Fy 2021 22 Ay 2022 23 Apnaplan Com Personal Finance Investment Ideas

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Calculating Taxable Social Security Benefits Not As Easy As 0 50 85 Moneytree Software

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Income Tax Slabs Tax Liability Comparison Between 2020 And 2019 Calculator Getmoneyrich

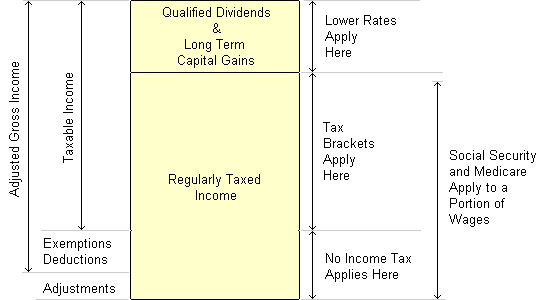

How To Calculate Federal Income Tax

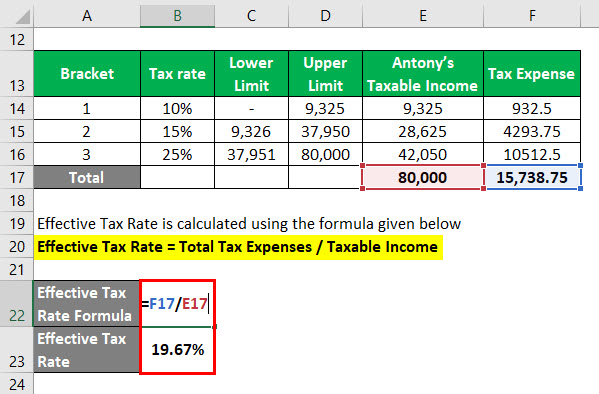

Effective Tax Rate Formula Calculator Excel Template

How To Calculate Federal Income Tax

How To Calculate Payroll Taxes Methods Examples More

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More